The Importing Process Visualized

We Make Importing Goods into Australia Straightforward

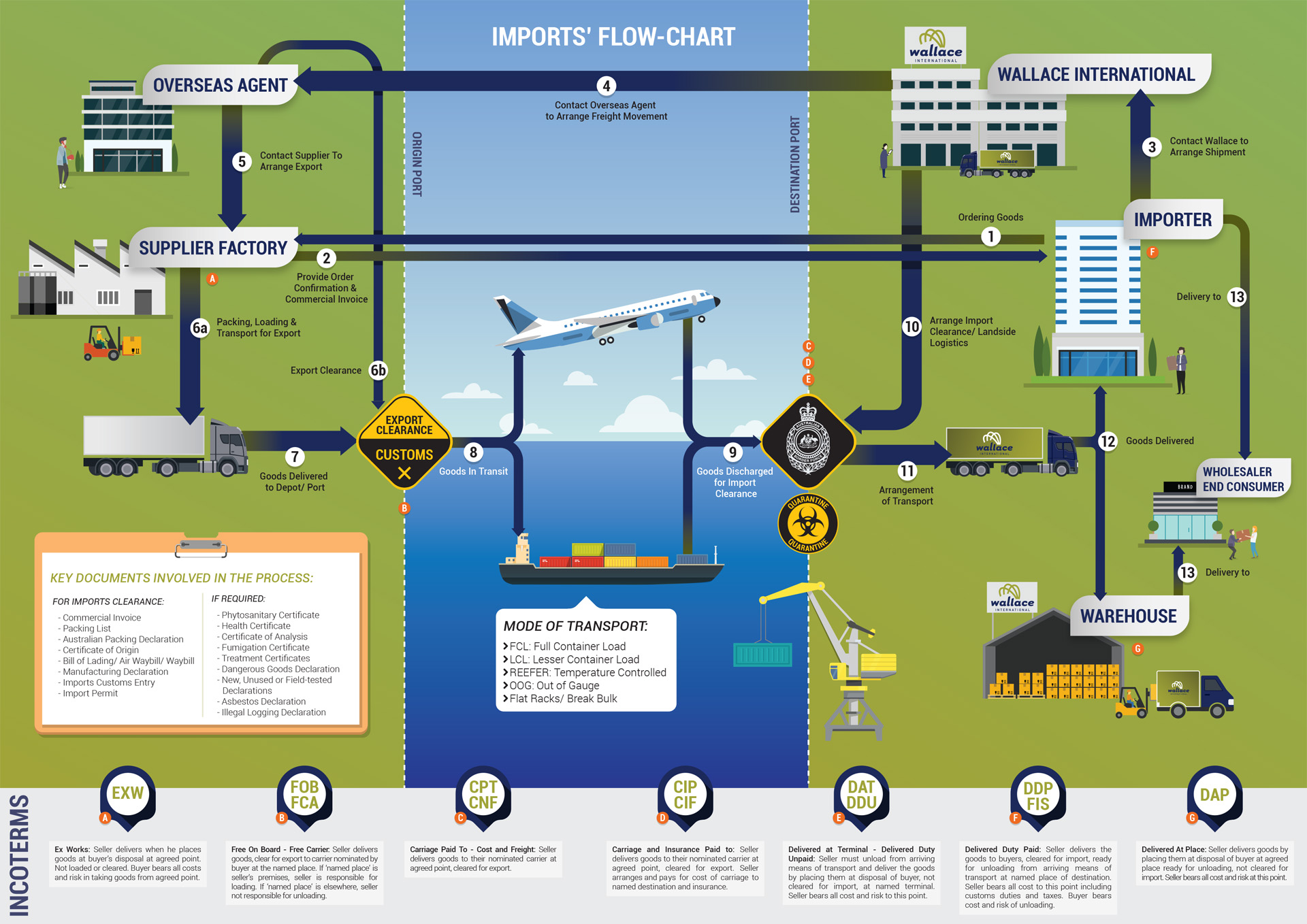

By buying and selling products and materials from overseas, you can grow your business exponentially. However, lots of complex regulations, laws and taxes affect your ability to trade internationally, and such rules can vary depending on where you’re importing from.

Import Tariffs, Free Trade Agreements, Certificates of Origin, Packing Declarations, Treatment Certificates, Import Permits, Regulatory Declarations etc., can appear daunting.

Fortunately, with the help and assistance of our Licensed Customs Brokers and experienced staff the processes of international trade can be simplified!

At Wallace International, we’re an Australian owned company that makes importing goods into Australia stress-free for First-Time Importers, businesses and corporations. We offer complete logistic services ex door, to door, Air or Sea freight, all clearance, transport and warehouse solutions tailored to individuals’ specific needs. Our specialists can assist with Customs Import Tariffs, laws and regulations as well as advice on Quarantine and our regulatory Government agencies.

If you want to learn about the process of importing into Australia without having to learn about tax, Customs and Import Tariff laws, then we’re the company to call.

Importing Products into Australia: How We Can Help

Our team of experienced brokers are trained experts in the field of Import Tariff, rates, laws and regulations. Whether you intend to import small or large, light or heavy, cheap or expensive, you can trust Wallace International to assist in all facets of International Trade. Our offices are based across the country, from Brisbane to Melbourne, Sydney to Perth, so are placed to cater for First-Time Importers where ever they are located.

Thanks to our wealth of experience and commitment to providing a superior level of service, we’ve mastered what can be complex procedures, such as importing goods from China to Australia. We truly believe there is no such thing as a “silly question” so, we’re more than happy to offer advice and answer questions over the phone or email, so call us today to find out how we can help you.

Utilise the Skills and Experience of Our Licensed Australian Customs Brokers

Understanding import tax in Australia and complying with the various regulations concerning International Trade are among the most challenging aspects of importing goods from overseas. A customs broker’s job is to know such regulations and clear your imports at customs on arrival. Your custom broker will:

- Prepare and submit any required documents/declarations and information to the relevant authorities.

- Ensure commercial documents comply with regulatory requirements.

- Check that your goods meet the state requirements that govern importing into Australia.

- Arrange any permit you may require.

- Classify your products correctly to minimise your tax liability

- Offer expert and impartial advice based on your business’s needs

Our Broad Range of Import Services

Clearing and managing the process of your imports isn’t the only complex service we offer here at Wallace International. Some of our most sought-after services for First-Time Importers and regular clients include:

- Education and understanding of the import process.

- Consultation of import requirements.

- Advice on freight Sea/ Air, containerised/ FCL/ LCL, breakbulk etc.

- Clearance and Transport Solutions.

- Import Tariffs, Import Duty and GST liabilities, Free Trade Agreements certificates and requirements.

- Quarantine Import regulations and requirements.

- Government regulatory agency requirements (e.g. :Illegal logging / Asbestos).

- Packaging – export quality.

- Insurance.

As you can see, we really are the only company you’ll ever need to make importing goods into Australia straightforward.

Checklist for First-Time Importers

Our job is to streamline the international trade process while minimising any risks associated with detention, penalties, infringement notices, trade restrictions and much more. Our complete checklist for first-time importers includes:

Pre-Purchase

- Product description and composition.

- Research and qualify potential supplier(s).

- Start the import process with supplier confirmation.

- Tooling/ Moulds, manufacturing set up costs – if applicable.

- Samples important for new products developed.

- Packaging/ labelling/ inners and outers.

- Production samples accepted and confirmed.

Purchasing

- Finalise product specification.

- Book shipment with Wallace International.

- Payment Arrangements finalised.

- Ship.

Post Purchase

- Wallace International – Customs and Bio-Security (Quarantine) clearance.

- Wallace International local transport.

- Wallace International – Warehousing – if applicable.

If you’re a First-Time Importer that wants to know how we can simplify all the above tasks, then don’t hesitate to give us a call.

TESTIMONIALS

Would You Like a Free Consultation?

We understand the importing and exporting process can be intimidating and confusing. If you require a face-to-face meeting with one of our experts our first consultation is free! One of our experienced staff will meet with you and answer any questions you have. Simply fill out the consultation request form and we'll get back to you as soon as possible.